|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

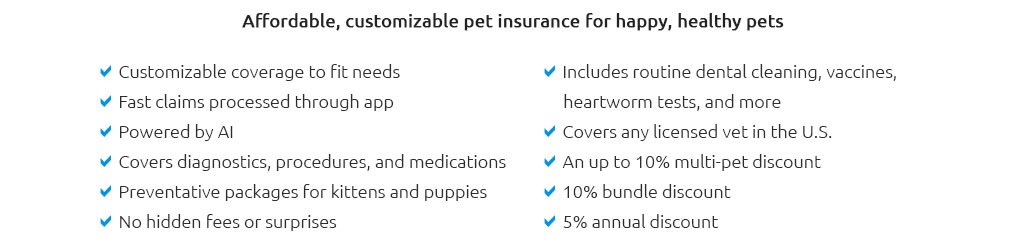

Understanding Cat Pet Insurance Plans: What to Expect and ConsiderCaring for your feline friend can sometimes come with unexpected expenses, making cat pet insurance plans a valuable investment for many pet owners. This article explores the different aspects of these insurance plans, helping you understand what to expect and consider before making a decision. Why Consider Cat Pet Insurance?One of the primary reasons to consider cat pet insurance is the peace of mind it offers. Veterinary costs can be unpredictable, and having insurance ensures you can provide the best care without financial strain. Unexpected Vet BillsAccidents and illnesses can occur at any time. Insurance helps cover these unforeseen expenses, so you're not caught off guard. Routine Care CoverageSome plans offer options to cover routine care, including vaccinations and regular check-ups, keeping your cat healthy throughout its life. Types of Cat Pet Insurance PlansThere are several types of insurance plans available, each designed to meet different needs and budgets.

To understand what influences the pet insurance cat cost, it's important to consider factors like the age, breed, and health of your cat. Factors to Consider When Choosing a PlanChoosing the right insurance plan for your cat involves evaluating several important factors. Coverage LimitationsReview the policy details carefully to understand any limitations or exclusions. Some policies may not cover pre-existing conditions. Cost and PremiumsCompare the cost of premiums against the coverage offered. It's crucial to find a balance between affordability and adequate protection. For those looking for the most economical option, researching the pet insurance cheapest price can be helpful. FAQ Section

By understanding the intricacies of cat pet insurance plans, you can make an informed decision that ensures your pet receives the best possible care without financial stress. https://www.pumpkin.care/cat-health-insurance/

If your kitty gets hurt or sick, a Pumpkin Cat Insurance plan can pay you back for up to 90% of eligible vet bills. This can make it easier to get the best care ... https://www.lemonade.com/pet/cats

Covers procedures like spaying or neutering, microchipping, six vaccinations, and more! Get a kitten package. Covers procedures like spaying or neutering, ... https://www.petsbest.com/cat-insurance

Cat Insurance Plans from Pets Best! - Coverage for the unexpected - Protection for both cats and kittens - Cover up to 90% on eligible vet bills*.

|